A federal judge overturned a rule change instituted by the Internal Revenue Service (IRS) that allowed certain nonprofits to forgo identifying major donors in tax filings with the agency.

In a 30-page ruling handed down July 30, Judge Brian Morris of the U.S. District Court in Great Falls, Mont., set aside the IRS’s decision of last summer and wrote that the tax agency violated the Administrative Procedure Act (APA) by not allowing public notice of the change or public comment, as required by law.

“This case involves a challenge to the process by which the IRS attempted to amend a regulation. Plaintiffs do not ask this Court to assess the merits of Revenue Procedure 2018-38. Plaintiffs ask simply for the opportunity to submit written data and opposing views and arguments, as required by the APA’s public notice-and-comment process, before it changes the long-established reporting requirements,” Morris wrote.

“A proper notice-and-comment procedure will provide the IRS with the opportunity to review and consider information submitted by the public and interested parties. Then, and only then, may the IRS act on a fully-informed basis when making potentially significant changes to federal tax law,” he wrote.

It’s unclear whether the IRS can or will appeal the decision. “The IRS does not discuss litigation,” a spokesperson said in a response to a request for comment.

Former Montana Attorney General and current Gov. Steve Bullock filed suit against the IRS and U.S. Department of Treasury in July 2018 to block the Trump Administration from dropping disclosure requirements for certain nonprofit organizations.

In its lawsuit, Montana alleged that the IRS could not waive the donor disclosure requirements, which were established by IRS regulation without providing an opportunity for public comment, in accordance with the APA.

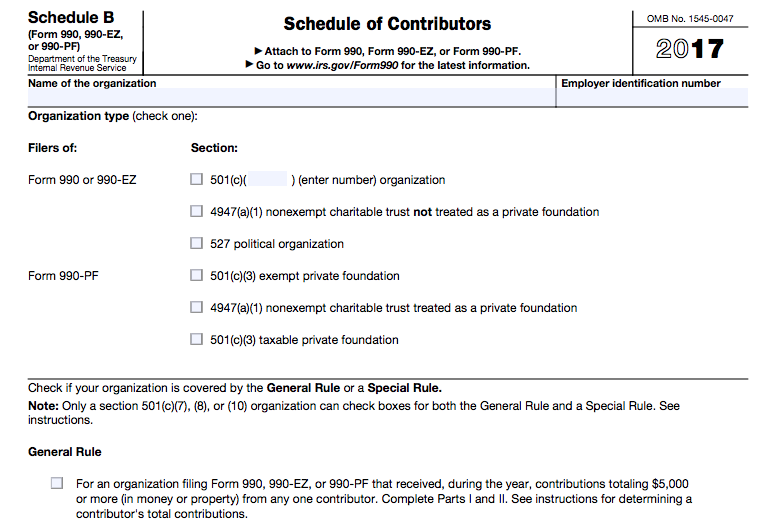

In July 2018, the IRS issued Revenue Procedure 2018-38, which allowed certain types of nonprofits, including 501(c)(4) social welfare organizations and 501(c)(6) professional and trade associations, to stop disclosing large donors as required on Schedule B of Form 990. Large donors are considered those who give $5,000 or more. Exceptions were for 501(c)(3) charities and Section 527 political organizations.

“When the federal government makes big changes that have been in place since Nixon was president, it has to follow the rules. The IRS didn’t follow the results, so we’re suing to enforce them,” Bullock said at the time. He is among nearly two dozen Democrats seeking the presidential nomination in 2020.

In March, New Jersey joined Montana in the lawsuit against the IRS and Department of Treasury. “This decision is a big win for democracy and for the rule of law. Not only did the IRS try to make it easier for dark money groups to hide their funding sources, it did so behind closed doors, without seeking public input. By setting the IRS’s decision aside, the court has ensured that the IRS will be held accountable for its actions – and dark money groups can be held accountable for theirs,” New Jersey Attorney General Gurbir Grewal said in a press release after last week’s ruling.